Market signals: What do they mean for Bitcoin (BTC) investors

The world of cryptocurrencies has recently been uncertainty and volatility. As Bitcoin (BTC) rises, many investors have come to the space, hoping to take advantage of their growth potential. However, as they have become so information about different sources, it can be overwhelming to dismantle market signals and make conscious investment decisions.

What are the market signals?

Market signals refer to indicators that provide an idea of market feelings, trends and possible future directions. They can be provided by various sources, including financial news, cryptocurrency analysis sites, social media platforms and even professional merchants.

In connection with Bitcoin (BTC), market signals refer to any information or data targets that may indicate whether the price is likely to rise, decrease or remain stopped. These signals may vary from technical indicators, such as moving averages and relative strength index (RSI) to basic analysis meters such as hash value, block fee and transaction fee.

Market signals

Bitcoin investors should be aware of:

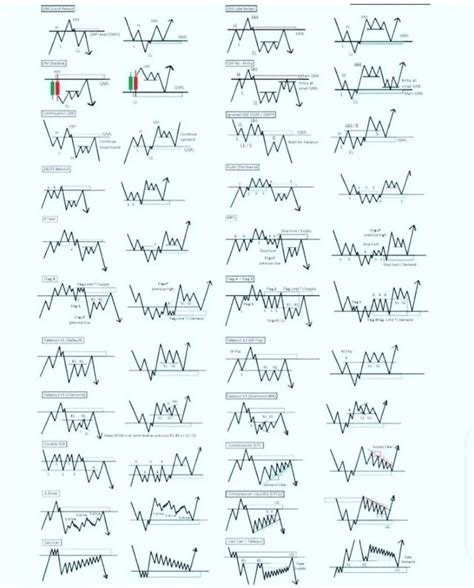

- Technical indicators : Moving averages, RSI, Bollinger lanes and other technical indicators can provide insights into the market trend and direction.

- Basic Analysis : Meters, such as Hash interest, block fee, transaction fees, and supply and demand, can help investors understand the basics of cryptocurrency.

- Social Media’s opinion : Twitter surveys, reddit comments, and social media messages can measure market feelings and potential purchasing or sales pressure.

- Financial indicators : GDP’s growth rate, inflation, interest and other economic meters can affect cryptocurrency prices.

- News and rumors : Breakthrough in technology, regulatory changes and big news can create market signals that are worth paying attention to.

How to use market signals

In order to make conscious investment decisions, it is necessary to understand how market signals are effectively interpreted. Here are some tips:

- Stay up to date : constantly tracking market signals from different sources.

- Your versatile portfolio : Apply investments between different cryptocurrencies and asset classes to minimize risk.

- Use the Trade Plan : Develop a trading plan that outlines your investment target, risk tolerance and access/exit strategies.

- Follow the basic factors : Keep an eye on fundamental analysis meters to stay up to date with the underlying economics of the cryptocurrency.

- Do not exceed

: Avoid overload by setting STOP loss and taking profits if necessary.

Case Studies: What Bitcoin investors have learned from market signals

- 2017 Rally : When the market opinion became positive, Bitcoin (BTC) experienced a significant price increase. Investors who used this trend had significant benefits.

- ** 2020: When the Covid-19 pandemic began to open, the market opinion changed to caution. This led to a significant repair of many cryptocurrencies, including Bitcoin (BTC) prices.

- Elon Muskin Impact: The rise and decline of Tesla’s CEO has been closely followed by investors who have used his tweets and his statements about Bitcoin (BTC).

conclusion

Market signals are essential tools for Bitcoin (BTC) investors in a constantly changing landscape of encryption. Understanding how market signals are effectively interpreted, investors can make conscious decisions that meet their investment goals.

As the cryptocurrency mode continues to develop, investors are crucial to remain alert and adapt their strategy as needed.